Building performance retrofits can offer an array of benefits to owners, occupants, and surrounding buildings, but financing those improvements is often a challenge. They are key to lowering energy usage, reducing carbon emissions, making buildings healthier and more comfortable for their occupants, and creating greater value for the community. Financing can be an obstacle for many building retrofit projects.

In an effort to break down that barrier, the Hub hosted, “Seeing Green: Financing Better Buildings” on Feb. 8 at the District Winery. This sold-out event provided information to the local building industry community on a range of financing and funding options for building performance improvements, and connected attendees with financial experts. Topics included federal and local government incentives, private lending solutions, PACE financing, green banks, and funding multifamily improvements. Keep reading for our takeaways and make sure to check out additional supporting resources below.

Sade Dennis with USBGC shares opening remarks. Photo Credit: Mariah Miranda.

Opening Remarks

The night began with emcees Yolanda Bonner and Mary Thomas from the Building Innovation Hub, and opening remarks from local industry experts, followed by two short presentations:

- Theresa Backhus, Director, Building Innovation Hub

- Matt Larson, Associate Principal, Arup

- Sade Dennis, Director of the Maryland, National Capital Region, and Virginia Communities for Market Transformation and Development, USGBC

- Ben Evans, Federal Legislative Director, USBGC

- Sonja Wells, Chief Lending Officer with City First Bank

Theresa kicked off the program with the Hub’s vision and services for the DC region, including a searchable directory for funding and financing opportunities, and thanking partners and sponsors who make this work possible.

Matt highlighted the work that Arup, a founding member of the Hub, is doing on decarbonization, including a recently published report prepared with USGBC on the state of decarbonization today.

Sade underscored how green finance is a priority topic for USGBC, an event partner, as evidenced by their recently released strategic plan which further outlines the goal of integrating green building into ESG frameworks used by the financial markets to assess risk and compliance.

Presentations

Ben shared key insights on new federal funding and government incentives for building performance improvements now available as a result of the Inflation Reduction Act. In particular, he highlighted:

- Tax deductions available for commercial buildings: Section 179D which expanded tax deduction of up to $5.00 per square foot for commercial building efficiency.

- Tax deductions available for home construction, including multifamily: Section 45L which increased to $2,500 per home for meeting ENERGY STAR Certification and $5,000 per home for meeting DOE Zero Energy Ready Homes program.

- Tax credits for clean electricity investment (Section 48) and alternative fuel vehicle refueling (Section 30C).

- The creation of a new “green bank” to stand up national climate financing initiatives through the EPA’s Greenhouse Gas Reduction Fund.

- Funding opportunities though HUD’s Green & Resilient Retrofit Program.

Sonja provided an overview of green lending opportunities with private financing, through the lens of City First Bank. She highlighted:

- As a community development financial institution (CDFI), City First is able to leverage New Market Tax Credits (NMTC) which incentivize community development and economic growth, and could be used as applicable for high-performance building improvements.

- One of the key vehicles for green financing is PACE lending, which allows property owners to access financing for the up-front costs of energy efficiency or other eligible improvements on a property and repay the investment over time through a special tax assessment. Many local financial institutions, including City First, have partnered with PACE administrator, DC Green Bank, to provide PACE loans.

- Additional clean energy lending options enable City First to finance renewable energy and energy efficiency projects including HVAC systems and building controls, energy-efficient windows, insulation and weather-proofing, water heaters, lighting systems, and/or solar panels.

- New opportunities in Green Lending include CDFI and MDI access to funding made available by the Greenhouse Gas Reduction Fund.

- Appraisal values are key to accessing capital. What this means for green lending, is that the amount of capital available to borrow depends on whether or not the appraiser has accurately factored in the long-term building performance investments on the value of the building. Architects and contractors have a role to play in documenting the value of high-performance building characteristics so that the lender can ensure the appraisal factors these enhancements into the value, and it helps if the appraiser is educated on clean energy enhancements.

DJ Soriano with Fannie Mae at the Funding Multifamily Improvements learning station. Photo Credit: Mariah Miranda.

Learning Stations

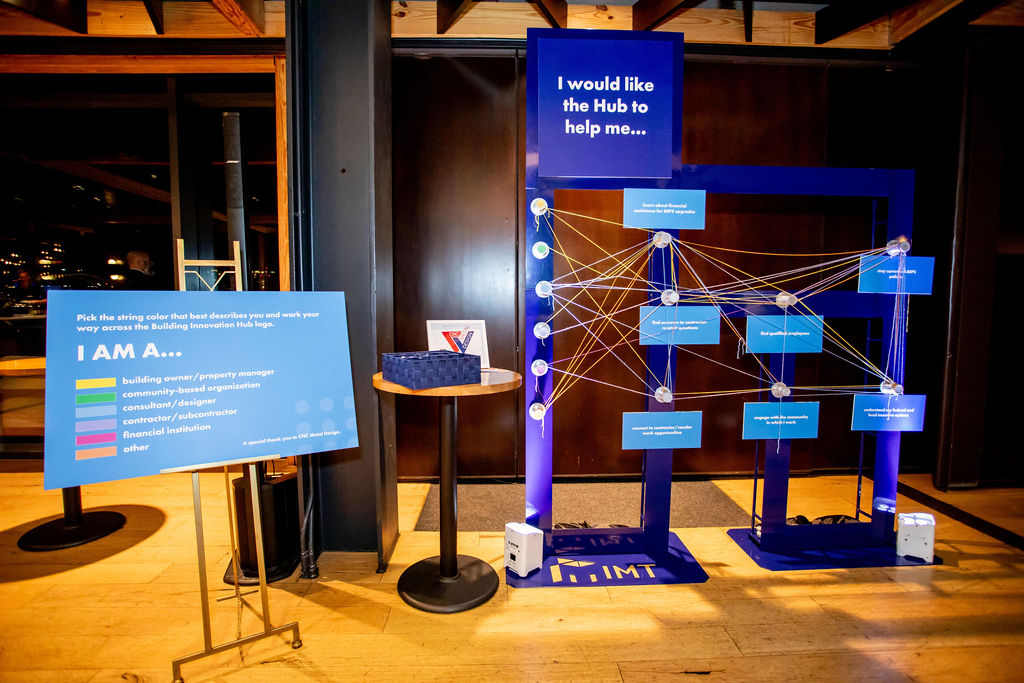

After hearing from our guest speakers, attendees broke into small groups at our interactive learning stations, hosted by financial experts. In an effort to make the content more accessible (and fun!), the Hub designed games for each learning station, giving the audience a chance to engage directly with experts in the field.

At the PACE financing station, Ronald Hobson, Director of the DC PACE Program at the DC Green Bank led the table through a game of Who Wants to be a Millionaire? He gave a high-level overview of PACE. Contestants were so engaged they were taking notes!

At the Federal Tax Incentives tables, Bryan Howard, Policy Advisor with the US Department of Energy, and Ben Evans with USGBC hosted jeopardy games covering federal incentives topics such as Section 179D and IRA Clean Energy Credits. Questions, such as “The Zero Energy Ready Home (ZERH) program has now expanded to these types of properties. What are low- and high-rise multifamily buildings?” fostered lively conversation and allowed the audience to engage directly with the station experts.

The Local incentives tables were led by Nick Burger, Deputy Director for Energy Administration at DC’s DOEE, David Epley, Associate Director with DOEE, and Rebecca Price, with the Maryland Energy Administration’s Clean Energy Hub. Covered topics in this game of jeopardy included DCSEU incentives and incoming applications for IRA funding. Questions were challenging and illuminated that there is limited public awareness of formal names and key requirements of many of the DC and MD energy incentives. Attendees got very into the game, and learned as much from each other as the structured content.

At the Funding Multifamily Improvements Learning Station, DJ Soriano, Lead Associate with Fannie Mae, and Autumn Leatham, SVP, Commercial Lending Team Lead at City First Bank, led their table through a simulation role-play game where participants had a chance to assess the best lending options for performance improvements at different multifamily property types. Participants learned that there are benefits to be had post-construction with some of Fannie Mae’s green lending offerings, and a few even got to play out real world exercises considering different options to propose for a property.

At the Green Banks table, attendees learned more about Green Banks and the services they offer through a simulation game led by Marc Ericson, Director of Financing Programs at DC Green Bank, and Gabriela Kluzinski, Investment Manager at DC Green Bank. Key takeaways included raising the awareness that funding available for every step of the way-including the necessary pre-work like audits and feasibility studies.

At the Private Lending Solutions table, participants flew through To Tell the Truth with Sonja Wells and her team. Building off of Sonja’s presentation, participants guessed between true and false statements to identify the true statement about CDFIs, green lending, and other solutions. The table engaged in lively discussion following the game.

Attendees identified needs against the backdrop of the Hub logo, fabricated by CNC Metal Design. Photo Credit: Mariah Miranda.

Resources

The Hub was honored to bring so many people with different backgrounds together to learn from experts, and from each other, on such an important topic as financing high-performance buildings. We will continue to build out resources to help the local building industry and make it easier to act and would love to hear from you on what you need to be successful.

In the meantime, here are some Hub and external resources on financing and incentives to bookmark:

Hub and Misc. Resources

- The Hub’s Funding & Financing Map

- The Hub’s Find-a-Vendor matchmaking

- U.S. DOE’s suite of resources, including the Financing Navigator and Funding and Incentives Resource Hub

- The HUD Exchange

- BOMA’s Energy Performance Contracting Model

Federal Incentives

- USGBC’s slides on IRA and Building Provisions

- IRS’s Credits and Deductions under the IRA

- The Hub’s IRA Section 179D blogpost

- DOE Section 45L guidance for Zero Energy Ready Homes and ENERGY STAR 45L guidance

- HUD’s Green and Resilient Retrofit Program

- EPA Greenhouse Gas Reduction Fund

Local Incentives

- DOEE’s IRA Rebates & Tax Incentives

- DCSEU’s Commercial and Multifamily Incentives

- DCSEU’s Affordable Housing Retrofit Accelerator

- Maryland Energy Administration (MEA)’s Incentives

Green Banks

PACE Programs

- DC PACE

- Maryland PACE

- Virginia PACE

- The Hub’s and AOBA’s Understanding PACE Financing webinar recording

Multifamily and Private Lending Solutions

- Fannie Mae Green Financing Options

- City First Bank PACE Lending and City First Enterprises Clean Energy Lending

- Community Development Financial Institutions (CDFIs) FAQs

Thank you to our generous event sponsors

Gold Sponsor:

Friend Sponsor:

Supporter Sponsors:

Event Partner: