**July 2025 update: 45L will end for homes acquired after June 30, 2026 (this applies to single-family, multifamily, and manufactured housing).**

This updated tax credit incentivizes contractors to build homes that consume less energy, resulting in lower energy bills for homeowners and in turn reducing greenhouse gasses. Single-family, manufactured, and multifamily homes are all eligible.

Co-authored by Building Innovation Hub, U.S. Green Building Council, DC Department of Energy and Environment.

Background

The Inflation Reduction Act (IRA) of 2022 enhances and creates new tax incentives for buildings and energy efficiency programs with the goal of reducing carbon emissions and creating jobs and other economic activity in the U.S.

For homebuilders, the new and improved Internal Revenue Code Section 45L New Energy Efficient Home tax credit (45L) under the IRA creates significant new incentives for new or substantially reconstructed energy-efficient homes. The IRA amended and extended 45L to increase the tax credit to up to $2,500 per unit for homes that meet ENERGY STAR certification and up to $5,000 for homes achieving the Department of Energy’s (DOE) Zero Energy Ready Home (ZERH) certification.

The incentive is in effect for 10 years, applying to homes that are acquired—sold or leased—from 2023 through 2032. Multifamily projects only (not single-family or manufactured houses) must meet federal prevailing wage requirements to be eligible for the full $2,500 ENERGY STAR credit per unit and $5,000 ZERH credit per unit.

45L Extended Eligibility

To qualify, eligible contractors—the person who owned and constructed or hired a third-party contractor to construct the qualified home (Notice 2023-65)—must construct or substantially reconstruct homes located in the United States, and receive certification through the ENERGY STAR or ZERH program. A common misperception is that the general contractor is the eligible entity, which is not the case unless the contractor also owns and pays taxes on the property. The eligible contractor is the taxpayer, or property owner, for the purposes of the 45L tax credit.

ENERGY STAR certification, overseen by the Environmental Protection Agency (EPA), requires:

- meeting above code levels of envelope performance and efficiency,

- installing enhanced mechanical equipment performance and air quality measures, and

- working with a credentialed Rater who will inspect, test, and verify that the home meets the requirements.

While existing homes are eligible, it’s important to note that ENERGY STAR has substantial envelope and foundation waterproofing requirements that can prohibit its use in most renovations.

DOE’s ZERH certification requires ENERGY STAR as a base level of efficiency and adds additional requirements for envelope improvements, duct location, solar and electric vehicle ready design, hot water heating efficiency, and further indoor air quality improvements.

Eligibility Dates and Program Versions

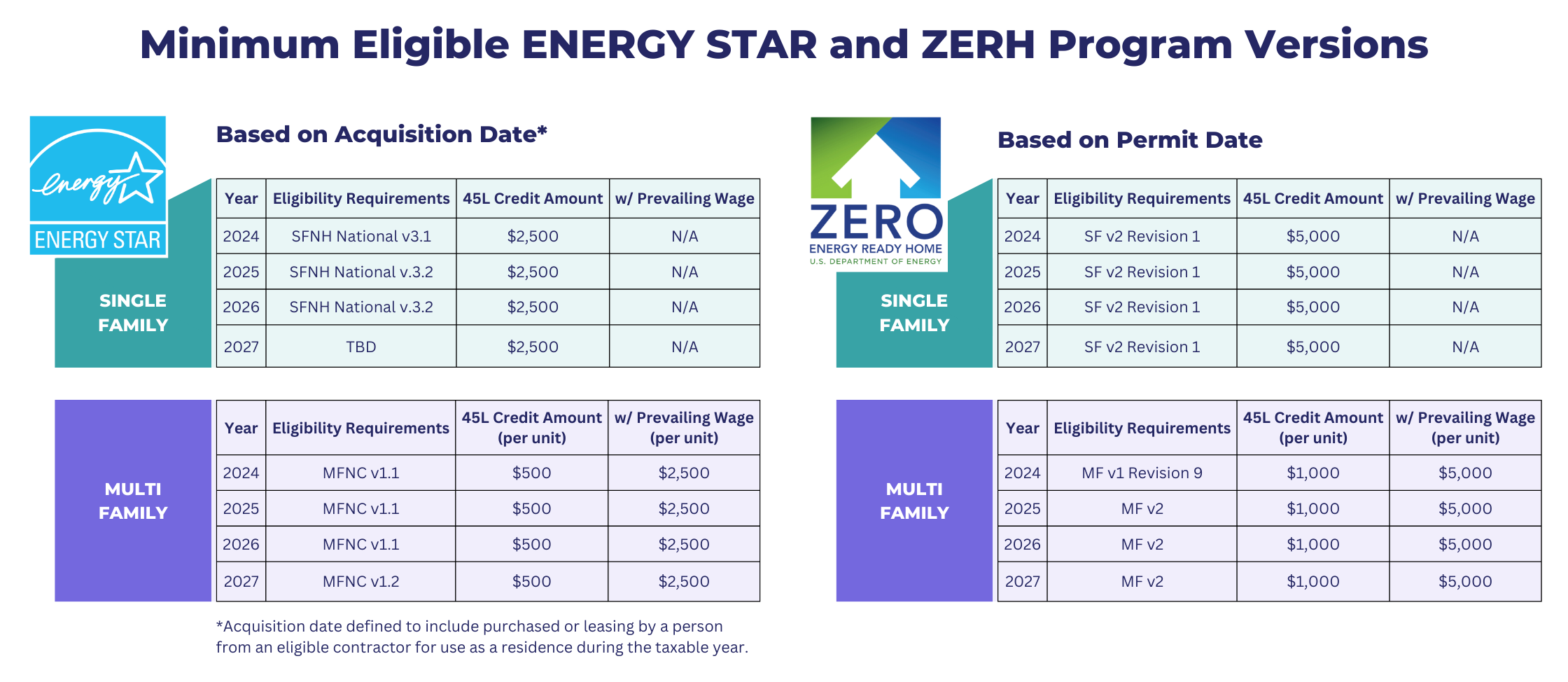

A key point to unlocking 45L tax credits is understanding the different eligibility requirements based on program versions, permit dates, and acquisition dates. ENERGY STAR and ZERH have different requirements and it is important for builders to ensure they are using the right version of the applicable program for 45L eligibility. More guidance on eligibility can be found under the IRS Credit for builders of new energy-efficient homes, and updates for future years will be provided annually in January.

The graphic above compares the minimum eligible ENERGY STAR and ZERH program versions for acquisition dates starting in 2024. The 45L tax credits are tiers of performance. You can earn the tax credit for either ENERGY STAR or ZERH, but not both combined.

45L Tax Credit Amounts

- ENERGY STAR Certification:

- Single-family: $2,500 for each home certified to applicable version of ENERGY STAR Single-family New Home (SFNH) program.

- Multifamily: $2,500 per dwelling unit for homes certified to applicable version of ENERGY STAR Multifamily New Construction (MFNC) program and meeting prevailing wage provisions. Credit drops to $500 per unit if wage provisions are not met.

- ZERH Certification:

- Single-family: $5,000 for each home certified to applicable version of ZERH Single-family Homes program.

- Multifamily: $5,000 per dwelling unit for homes certified to applicable version of ZERH Multifamily program, and meeting prevailing wage provisions. Credit drops to $1,000 if prevailing wage provisions are not met.

Prevailing Wage and New Labor Standards

To receive the highest tax credit in both tiers ($2,500 or $5,000 per unit), 45L requires multifamily projects (but not single-family or manufactured homes) meet prevailing wage standards. Unlike some other IRA tax incentives, apprenticeship requirements do not apply to 45L.

To qualify, eligible contractors need to:

- Ensure that all laborers and mechanics employed in construction, alteration, or repair are paid wages at rates determined by the Department of Labor. Applies to all contractors, subcontractors, and employees under both.

- Meet specific recordkeeping requirements, including payroll records that reflect the hours worked in each classification and the actual wages paid.

For initial guidance on prevailing wage, please see Notice 2022-61 or see more information about prevailing wage rates from the Department of Labor here.

Multifamily Example

An eligible contractor builds a multifamily building that meets ENERGY STAR Multifamily New Construction (MFNC). As noted above the eligible contractor is the property owner. The project is expected to begin construction in 2024 and finish in 2026. With an expected completion date and anticipated acquisition date of 2026, ENERGY STAR MFNC v1.1 is the applicable version for 45L tax credit eligibility. However, to account for potential delays which could push the sale of some or all units into 2027, and to ensure that eligibility for the tax credit remains intact for the whole building, the builder decides to design to MFNC v1.2, which is the required version to be eligible for the tax credit with a 2027 acquisition date. The project meets prevailing wage requirements and is certified to MFNC v1.2. So whether the contractor leases the apartments in 2026 or 2027, or partially leases the units in 2026 and finishes in 2027, they are eligible for the 45L tax credit of $2,500 per unit to be taken on their 2026 or 2027 return, depending on when the units are leased.

Single Family Example

In another example, an eligible contractor, which is also the property owner, builds a single family home that meets ENERGY STAR Single Family New Homes (SFNH). The project is expected to begin construction in 2024 and finish in 2025. Based on a permit date of 2024, the project can apply for ENERGY STAR SFNH v3.1, however, to qualify for 45L, the contractor must apply for ENERGY STAR SFNH version 3.2. The project finishes per schedule and is certified to SFNH version 3.2. The eligible contractor sells the home and can file for the 45L tax credit of $2,500 on their 2025 return.

Additional Details

Unlike other tax incentives in the IRA, 45L is not eligible for “direct pay” provisions that allow nonprofits and government entities to access the tax credits, even when they don’t have tax liability. That said, the IRA did include a provision aimed at helping nonprofit affordable housing builders use 45L alongside the Low Income Housing Tax Credit (LIHTC). The provision allows builders to take the 45L tax credit without reducing their LIHTC basis.

Additionally, while the IRS has not yet released guidance, it is widely expected that builders will be eligible to take both the 45L tax credit and the Section 179D deduction on larger multifamily projects. 179D, which provides a deduction of up to $5.00 per square foot for energy-efficient construction, is available to buildings in the scope of ASHRAE Standard 90.1, which applies to buildings four stories and higher.

Consult a Tax Professional

This article is not intended as tax advice and should not be used for purposes of determining eligibility for tax incentives. Individuals or entities looking to claim the 45L tax credit should consult with a tax professional to determine eligibility, process, and applicability with other Federal incentives.