**July 2025 update: 179D will be repealed for projects that begin construction after June 30, 2026.**

Co-authored by Building Innovation Hub, U.S. Green Building Council, DC Department of Energy and Environment

Background

The passage of the Inflation Reduction Act (IRA) in 2022 saw the Federal Government commit billions of dollars in new spending and tax incentives to building energy efficiency and electrification programs.

While a significant amount of that money is dedicated to supporting individual taxpayers with making upgrades in their homes, the IRA also revamped, and expanded, the Sec. 179D tax deduction for energy efficient commercial buildings. For the purposes of this deduction, a commercial building is considered any building that can be modeled using ASHRAE 90.1 methodology, including residential buildings greater than 3 stories. Please see note 1 for additional information on applicable buildings.

This update provides an opportunity for building owners to take advantage of building energy efficiency strategies that align with the District of Columbia’s Building Energy Performance Standards (BEPS).

Expanded Eligibility

One of the significant changes to the 179D program is that existing buildings which reduce energy use intensity (EUI) by 25% to 50% from their pre-retrofit baseline are now eligible for the tax deduction. This means that building owners making upgrades required to comply with BEPS can now take advantage of 179D to reduce their income tax burden on the property.

Previously, 179D was largely tailored to new construction projects eligible to receive an ASHRAE 90.1 energy model (specifically, commercial buildings and residential properties greater than 3 stories). That new construction pathway remains. But broadening its scope to allow existing buildings to utilize an EUI reduction approach significantly expands access to the program. More buildings can claim deductions based on actualized energy savings—a goal of BEPS—rather than rewarding buildings for modeled efficiency improvements compared to an ASHRAE 90.1 baseline.

And there is more money available. Before the IRA, there was a set deduction of $1.80 per square foot; now there is a sliding scale of $2.50 to $5.00 per square foot.

179D Process for Existing Buildings

While we await specific guidance from the IRS later in 2023 outlining how building owners can demonstrate compliance with the retrofit pathway, there is a lot we know now. Existing buildings (officially referred to as “energy efficient building retrofit properties” in the IRA) that are five years or older are eligible for the 179D tax deduction by meeting the following requirements:

- Cannot have previously claimed 179D deduction as a new building.

- Establish a baseline site Energy Use Intensity (EUI). If your building is already benchmarking under the DC benchmarking regulations, site EUI can be found in ENERGY STAR Portfolio Manager.

- Develop a “Qualified Retrofit Plan”. Must be a written plan developed by a “Qualified Professional” (licensed architect or professional engineer) that:

- Certifies current site EUI;

- Identifies the recommended upgrades to interior lighting, heating, cooling, ventilation, hot water, or envelope systems;

- Certifies that the recommended upgrades to the building were installed, and;

- Certifies the building’s improved site EUI no less than one year after the date of the building improvements.

- Reduce Site EUI by at least 25%. Buildings are eligible for a $2.50 per square foot deduction for cutting site EUI by 25% rising on a sliding scale to $5.00 per square foot if they save 50% energy or more.

179D and BEPS Opportunities

Buildings that are subject to BEPS should consider taking advantage of 179D as it aligns closely with some of the BEPS requirements and may enable buildings to claim a deduction as they pursue compliance.

Many buildings will already have developed the required qualified retrofit plan, and can therefore focus on implementing the plan to reduce site EUI as required by both BEPS and 179D. Once the building has reduced EUI by at least 25% (no less than one year after the plan is placed in service), the owner is eligible to receive the tax deduction. Buildings pursuing larger retrofit projects for the Accelerated Savings Recognition (ASR) alternative compliance pathway for BEPS will be eligible to claim this deduction at higher levels while also securing BEPS compliance for 2 or more cycles.

At any time during a BEPS Compliance Cycle, a building owner may apply to DOEE to change the Pathway by submitting a Pathway Change Application through the Portal. Also, DOEE encourages early communication in the process by contacting via the HelpDesk or email building.performance@dc.gov.

Interviews from the Field

New Labor Standards

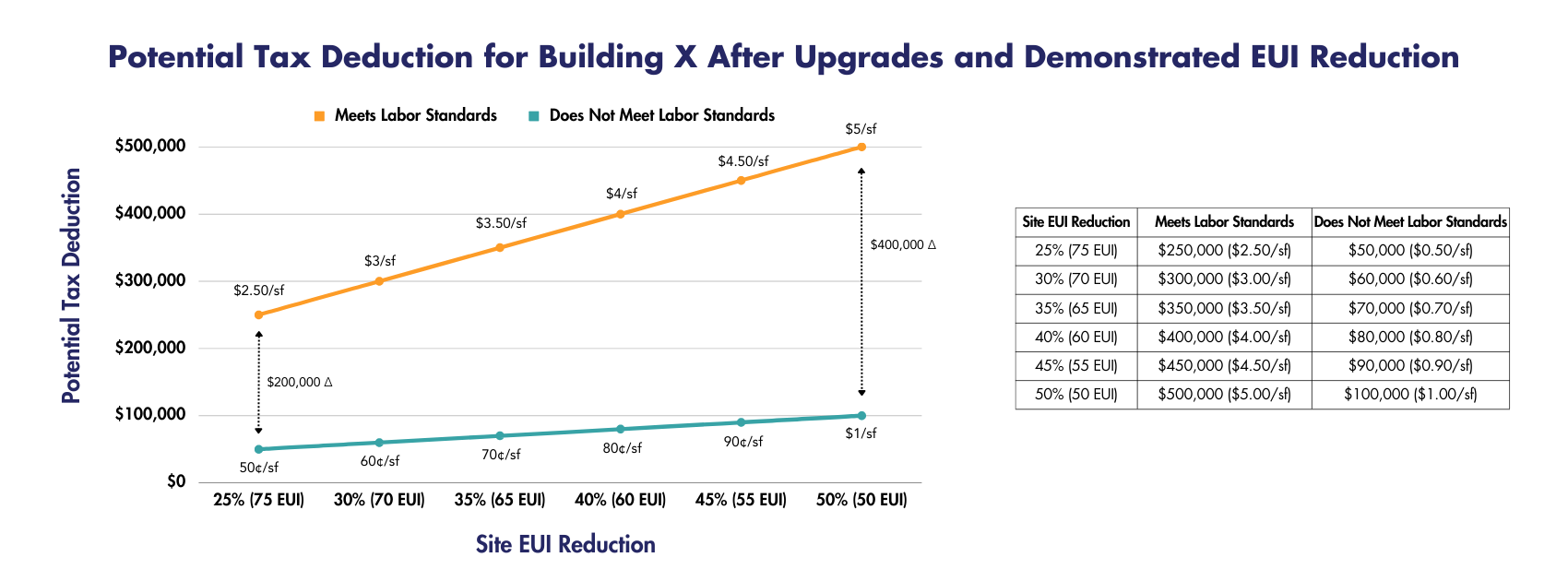

To receive the full tax deduction, the new 179D requires projects to meet wage and apprenticeship standards on the project—including for contractors and subcontractors. Projects that do not satisfy these labor standards are still eligible for tax deductions, but at a significantly lower rate of $.50-$1.00 per square foot vs. the full deduction of $2.50-$5.00. To qualify for the full deduction amount, projects must:

- Employ apprentices as 10%-15% of the project workforce depending on project start date.

- Pay their workers at prevailing labor rates determined by the Department of Labor, while maintaining records of the names of individual laborers and their wage rates.

The Building Innovation Hub has a High Road Contracting toolkit to help decision makers embed supplier diversity, livable wages, and equity into their procurement process.

Project Example

Here’s a hypothetical project that demonstrates the potential additional savings if projects meet the new labor standards. This is for informational purposes and does not guarantee all buildings will be eligible for deductions in the amounts identified, even if the savings shown are met or exceeded.

Building X is a 100,000 square foot commercial office built in 1995 with an ENERGY STAR score of 65. Because the building does not meet the BEPS, the owner has selected a compliance pathway and hired a qualified professional to develop a retrofit plan to significantly reduce the building’s EUI.

Contractors are scheduled to perform significant upgrades to building mechanical and lighting systems, and ownership is interested in filing for the 179D tax deduction upon completion of the upgrades and verification of the new EUI.

The qualified professional finalized the retrofit plan on March 1, 2023 and certified the building’s site EUI as of December 31, 2022 as 100 kBTU/sf. The retrofit is scheduled to be completed by December 31, 2024 so the building has time to make any adjustments needed to guarantee the 20% site EUI reduction required for the BEPS Performance Pathway during the evaluation year (2026). The table below demonstrates the potential tax deduction for Building X after it has completed its upgrades and demonstrated its EUI reduction:

Looking Ahead

The expanded 179D program allows many more buildings, including those that are subject to the BEPS, to take advantage of the tax deduction for energy efficiency. The labor standards required to achieve the increased tax deduction, though new, are important to ensuring equitable construction practices in high-performing building retrofits.

Final Rules for the revisions to 179D are still being developed, so this blog will evolve as we learn more about how the Federal government will treat certain situations. While the Department of Treasury and the IRS are still establishing rulings pertaining to the tax deduction, the current guidance makes it clear that the program is a valuable resource for existing buildings looking to improve performance and comply with BEPS. Forthcoming Federal guidance will likely include:

- How the EUI baseline and EUI savings are calculated

- Energy modeling requirements

- Requirements for verifiers and qualified retrofit plans

- Details regarding prevailing wages and apprenticeship hiring requirements

- Other submission, documentation, and record retention requirements

- Whether or not ENERGY STAR Portfolio Manager will be used to document EUI, and what to do if the data is changes

- If BEPS Prescriptive Pathway documentation can be used for the Qualified Retrofit Plan, and if an individual qualified to be an Energy Data Verifier in the District can also be considered a “Qualified Professional” to write that plan

As with all tax matters, it is important to speak with a qualified tax professional or attorney to evaluate the potential impact of these deductions for your property. Other resources available to support you include:

- The Building Innovation Hub’s High Road Contracting Toolkit

- U.S. Green Building Council Guide to Green Buildings and the IRA

- IRS’s Notice of Prevailing Wage and Apprenticeship Initial Guidance Under Section 45(b)(6)(B)(ii) and Other Substantially Similar Provisions

- Real Estate Roundtable’s Inflation Reduction Act of 2022 Fact Sheet: Clean Energy Tax Incentives Relevant to U.S. Real Estate